*Image from the internet; all rights belong to the original author, for reference only.

Table of Contents

ToggleInfineon Acquires Marvell’s Automotive Ethernet Business: A Strategic Shockwave in In-Vehicle Networking

On April 7, 2025, Infineon Technologies announced a $2.5 billion all-cash acquisition of Marvell’s automotive Ethernet business, with the transaction expected to close later this year. The deal encompasses not only product portfolios and technologies but also Marvell’s existing automotive customer base and intellectual property assets.

This business currently generates annual revenues between $225 million and $250 million, with a robust gross margin of around 60%. Marvell’s customer list includes eight of the world’s top ten automotive OEMs and boasts more than $4 billion in design win backlog.

Q1: Why Is Automotive Ethernet Becoming a Battlefield for Semiconductor Giants?

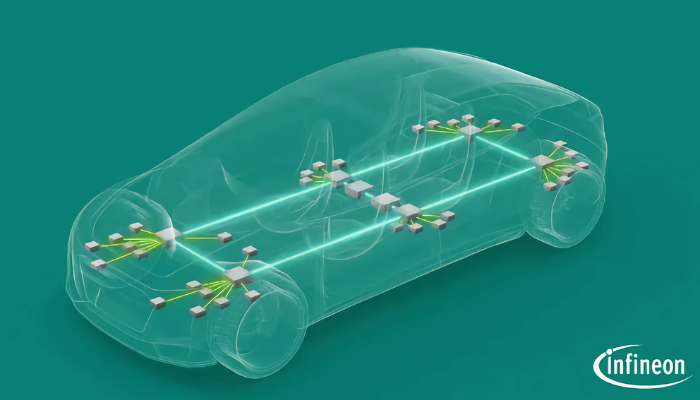

Driven by the rise of electric vehicles, advanced driver assistance systems (ADAS), and particularly the transition to Software-Defined Vehicles (SDVs), traditional automotive communication protocols like CAN and LIN are struggling to meet the demands of high-bandwidth, low-latency, and cross-domain data transmission.

Automotive Ethernet offers several compelling advantages:

Scalable Bandwidth: Supports transmission rates from 100 Mbps to 10 Gbps, addressing the growing need for sensor, radar, and camera coordination.

Flexible Topology: Easily accommodates zone-based architectures and centralized computing platforms.

Standardization and Cost Efficiency: Replaces legacy proprietary protocols, paving the way for modular hardware and software development.

This makes automotive Ethernet the foundational layer for SDVs and a strategic high ground being contested by Infineon, Broadcom, Renesas, and others.

Q2: What Does This Acquisition Mean for Infineon? More Than Just Expanding the Chip Portfolio?

- Enhancing Complete SoC System Solutions for Automotive

- Infineon has long held strong positions in automotive MCUs, power semiconductors, and security chips. However, it lacked high-speed in-vehicle networking capabilities. Integrating Marvell’s Brightlane PHY/Switch portfolio closes this gap, enabling a unified “chip + network” closed-loop system.

- Stepping into Core SDV Infrastructure

- Ethernet is foundational to key SDV components such as central gateways, domain controllers, and OTA updates. This acquisition positions Infineon to evolve from a component supplier to a full-fledged platform solution provider.

- Gaining Access to Tier-1 and OEM Ecosystems

- With customers including Toyota, VW, Hyundai, and Bosch, Marvell’s client base offers Infineon rich cross-selling opportunities and a strengthened market footprint.

Highlighted Products from Marvell’s Brightlane Line:

- 88Q2220M: A 1000BASE-T1 PHY transceiver with strong interference resistance, ideal for ADAS and gateways, AEC-Q100 qualified.

- 88Q5050: A multiport Ethernet switch supporting AVB and TSN protocols for deterministic communication across vehicle nodes.

- 88QB5220: A bridge chip that enables rate conversion between different Ethernet segments, essential for integrating heterogeneous sensor networks.

Q3: Strategic Retreat or Sharp Focus for Marvell?

This divestiture reflects a strategic refocusing rather than a retreat. Over the past two years, Marvell has pivoted toward cloud, AI, and custom silicon. While automotive Ethernet holds long-term promise, its lengthy design cycles and demanding qualification requirements are misaligned with Marvell’s asset-light and growth-focused strategy.

By selling at a premium valuation, Marvell frees up capital to double down on its high-margin AI and data infrastructure segments. Notably, in Q4 FY2025, data center revenue reached $1.366 billion—roughly 75% of total revenue—highlighting the growing dominance of this business line, though full-year trends await the official annual report.

Q4: Who Are the Stakeholders Most Affected by the Deal?

Stakeholder | Impact Summary |

As the incumbent leader in automotive Ethernet, now faces intensified competition and may expedite partnerships with Tier-1 suppliers. | |

Renesas Electronics | Offers MCU + Ethernet solutions; may face margin pressure in light of Infineon’s more integrated offerings. |

Tier-1 Integrators (e.g., Bosch, ZF) | Could reevaluate chip platforms in favor of more cohesive “one-stop” control + communication providers. |

Distributors & Solution Providers | Will need to adjust supply chain strategies as Marvell’s Ethernet portfolio becomes part of Infineon’s ecosystem. |

Q5: What is the practical impact on the electronic component supply chain?

Short-Term:

- Channel Restructuring: Marvell’s Ethernet products will be absorbed into Infineon’s distribution and certification systems, potentially affecting delivery timelines and qualification pathways.

- Higher Market Concentration: Smaller distributors may need to upskill in system integration or pivot to niche segments.

Mid-to-Long Term:

- Greater Integration in Components: Standalone PHY and switch chips may increasingly be integrated into SoCs.

- Redesigned BOM Structures: Gateway designs will shift to prioritize high-bandwidth, low-power solutions, setting new standards for in-vehicle computing.

Pressure on Local Players: Chinese vendors like Willsemi and GigaDevice may feel the squeeze, particularly in low-to-mid-speed Ethernet or domain-level MCU segments.

Example:

Infineon’s AURIX™ TC3xx/TC4x MCU series already supports gateway and domain controller roles. If future generations natively integrate PHYs like the Brightlane 88Q2112 or work closely with 88Q5050 switch chips, this could significantly enhance system-level integration and design efficiency.

At the same time, engineers should closely compare alternatives like NXP’s TJA1103 PHY in terms of compatibility and certification paths.

Actionable Advice: Supply chain teams should proactively assess Infineon’s lead time policies, delivery schedules, and potential certification updates to prevent disruption of critical automotive programs.

Q6: Does This Signal a New Wave of Semiconductor M&A?

Absolutely. This could be the harbinger of a new round of strategic M&A in automotive semiconductors:

- System Solution Thinking Drives Capital: It’s no longer about chip specs alone, but end-to-end delivery: compute + connectivity + security.

- Beyond AI Mania: Rational capital is returning to long-cycle, high-sticky markets like automotive and industrial.

- Rising Heat in Edge Compute + Communication: Fusion of Ethernet + MCU + CAN-FD is emerging as the new battleground for traditional automotive chipmakers.

Final Insight

Infineon’s acquisition isn’t just about “buying a product line.” It’s a calculated strategic move that addresses core gaps in high-speed automotive networking, leverages Marvell’s ecosystem, and positions Infineon as a top-tier SDV enabler.

From a supply chain perspective, this is a landmark acquisition. It marks a shift from standalone communication chips to platform-based integration and signals a deeper reshuffling of competition in the automotive semiconductor industry.

© 2025 Win Source Electronics. All rights reserved. This content is protected by copyright and may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Win Source Electronics.

COMMENTS